SINGAPORE:

Electronic Road Pricing (ERP) charges at certain gantries along the

Central Expressway (CTE) and Pan-Island Expressway (PIE) will be

adjusted from 7 May.

Motorists using the southbound CTE before Braddell Road between 9am and 11am will not have to pay ERP charges.

Currently, they pay 50 cents.

Motorists using the PIE slip road into CTE between 7.30am and 8am will pay 50 cents less - at S$3.00.

However, ERP rates for four gantries along the southbound CTE after Braddell Road will go up.

The rate will increase by 50 cents - from S$1.50 to S$2 - between 7.30am and 8am.

Between 8am and 8.30am, they'll have to pay S$3, an increase of S$1.

The

Land Transport Authority (LTA) said on Monday that it adjusted the

rates as part of its quarterly review of traffic conditions on

ERP-priced roads and expressways.

The next ERP review will take place in May for the June school holidays.

Monday, April 30, 2012

Singapore's jobless rate rises to 2.1% in March

SINGAPORE: Fewer

jobs were created in the first quarter of the year, but the Ministry of

Manpower said the domestic job market remains "fairly strong".

An estimated 27,400 new jobs were created in the first quarter of 2012, compared to 37,600 the previous quarter, and 28,300 the same time last year.

Unemployment rose slightly, to 2.1 per cent from last December's two per cent.

UniSIM School of Business' Business Programme head Randolph Tan said it is the start of an inevitable slowdown, as Singapore passes the peak of its economic recovery.

"From this point onwards, I expect to see the employment situation decline but not significantly deteriorate," Associate Professor Tan said.

"One of the reasons why, is because of the fact that government policy, to a large extent, has been anticipatory in trying to deal with the potential decline in demand [for labour].

"So the reduction in the influx of foreign manpower to some extent, will help hold up the labour market."

Assoc Prof Tan said he expects unemployment to creep up to about 2.5 per cent by year-end.

Meanwhile, in a blog post, Minister of State for Manpower Tan Chuan-Jin said higher unemployment is to be expected, as companies restructure or go offshore.

Workers will be affected, but he said his ministry will help them through the transition.

Singapore's latest employment data is set against a much bleaker global situation.

The International Labour Organisation has warned that the global employment situation is alarming, especially in Europe, where austerity measures are hurting job markets.

As the economy stays buoyant, some recruiters expect Singapore to reconsider its recent curbs on skilled foreign manpower.

Randstad regional director Karin Clarke said: "I think government is committed to restricting the number of foreign workers, particularly at the unskilled and semi-skilled layer.

"Those restrictions are here to stay. But I think there will be some easing when you look at professionals and the qualified level because Singapore's long-term growth depends on being able to bring in the skill sets to upskill the Singaporean workforce.

"Training and education come from overseas expertise, so if we continue to attract large R&D centres, then we need to be bringing those people in that can train the workforce.

"I also don't think Singapore probably has enough people to support all of that growth."

But for the unskilled foreign worker, observers said the restrictions are here to stay.

An estimated 27,400 new jobs were created in the first quarter of 2012, compared to 37,600 the previous quarter, and 28,300 the same time last year.

Unemployment rose slightly, to 2.1 per cent from last December's two per cent.

UniSIM School of Business' Business Programme head Randolph Tan said it is the start of an inevitable slowdown, as Singapore passes the peak of its economic recovery.

"From this point onwards, I expect to see the employment situation decline but not significantly deteriorate," Associate Professor Tan said.

"One of the reasons why, is because of the fact that government policy, to a large extent, has been anticipatory in trying to deal with the potential decline in demand [for labour].

"So the reduction in the influx of foreign manpower to some extent, will help hold up the labour market."

Assoc Prof Tan said he expects unemployment to creep up to about 2.5 per cent by year-end.

Meanwhile, in a blog post, Minister of State for Manpower Tan Chuan-Jin said higher unemployment is to be expected, as companies restructure or go offshore.

Workers will be affected, but he said his ministry will help them through the transition.

Singapore's latest employment data is set against a much bleaker global situation.

The International Labour Organisation has warned that the global employment situation is alarming, especially in Europe, where austerity measures are hurting job markets.

As the economy stays buoyant, some recruiters expect Singapore to reconsider its recent curbs on skilled foreign manpower.

Randstad regional director Karin Clarke said: "I think government is committed to restricting the number of foreign workers, particularly at the unskilled and semi-skilled layer.

"Those restrictions are here to stay. But I think there will be some easing when you look at professionals and the qualified level because Singapore's long-term growth depends on being able to bring in the skill sets to upskill the Singaporean workforce.

"Training and education come from overseas expertise, so if we continue to attract large R&D centres, then we need to be bringing those people in that can train the workforce.

"I also don't think Singapore probably has enough people to support all of that growth."

But for the unskilled foreign worker, observers said the restrictions are here to stay.

Couple pen 'bucket list' for their baby with terminal illness

What do you do when your 6-month-year-old daughter is diagnosed

within incurable genetic disease, and will very likely not live long

beyond her second birthday?

For Mike and Laura Canahuati, they chose to write a blog in her name - detailing their daily joys and trials with her, accompanied with a 'bucket list' of things to accomplish before her death.

Baby Avery was diagnosed with Spinal Muscular Atrophy (SMA) Type 1 on a Good Friday, June 4, 2012.

This means that little

Avery, who has already lost her ability to move her legs, will

eventually lose the ability to move her arms and her head.

When this happens, it will become increasingly difficult and in the end impossible for her body to pump air through her lungs.

This is why most babies diagnosed with SMA Type 1 have a life expectancy of less than two years of age.

There is even the possibility of dying a few months or even weeks after birth. Even with the help of a respirator, life expectancy can only be stretched till ten years of age.

One in 6,000 babies is born with one of four types of SMA, with Type Zero the worst. However, that usually occurs with fetuses, the couple said.

Much of the blog, written in the first person in Avery's voice, is the work of the father, Mike.

He writes: "My mommy, daddy, and grandparents have chosen to help me fight this disease, while embracing this news and helping me chronicle my "bucket list" experiences through this blog."

"So at this point, my family & friends can either sit back and watch me die and let my life be about doctors visits and tear filled days, or everyone can embrace what my future holds and we can make each day I'm here a memorable one...starting now."

Light-hearted and humorous, the blog and the bucket list is written as though Avery will live far beyond her estimated life expectancy and experience life's milestones.

In her wish-list, 'Avery' writes her hopes of 'attending a sleep over', 'going hiking', to 'play dress up in my mommy's closet and have a photo shoot' and 'celebrate my real 1st birthday'.

Others include:

Since the 31-year-old

first time father started penning the blog for his daughter, the blog

has gone viral, accumulating more than a million page views and

counting.

"Today started like most days, I woke up, ate breakfast through my glam-tube, took a bath, and then checked my blog to see if anyone is reading my story and helping me spread awareness about SMA.

"Well, when I woke up yesterday I had 480,000 pageviews and as of right now I have 1.29 million pageviews (and that number is increasing by about 2.5 pageviews per second).

"Holy...Shitake mushrooms??? Umm, I'm not certain, but I believe they are with the rest of the produce sir. Ugh sorry, do I look like work here? Anyway, where was I?", reads one of the latest entries.

Mike, an insurance company owner, says he conjures up a little girl's perspective when he writes. He added that many people are surprised to find out it's the dad, not mom, typing out the sensitive tear-jerker entries.

The couple first began the blog as an efficient way to keep family and close friends in touch about little Avery's health.

In each post, they include a plea for readers to share Avery's story in the hope of spreading SMA awareness.

In her voice, they call on couples to get SMA testing, and medical organisations and insurance companies to offer SMA testing, so nobody has to go through what Avery's family is going through every day.

"The only way to do this is to make people aware of SMA so they know they have the OPTION of getting tested for it. That's all I want and that's all my mommy & daddy want for me and all of my future friends," 'Avery' writes.

The list began as the wistful imagination of Mike and Laura living out a normal life with Avery through her teenage years and beyond, wishing for her to try cupcakes, fly a kite and blow bubbles.

But slowly, emails started pouring in with people asking them to add things into the list.

Crossing items off the list

Others offered help for the Canahuatis to strike off items from the list.

To date, Avery has gone

on a road trip, been a cheerleader, had a birthday party, driven a car,

and opened a birthday gift from a stranger.

In April 2012, Avery even got to throw the first pitch at a Sugar Land Skeeters baseball game.

During the game held in honour of SMA awareness, Mike got to strike off several more items off the list, including:

1. Go to my first baseball game

2. Throw out the first pitch at a baseball game

3. Throw a strike...whatever that means

4. Have thousands of people cheer for me at once

5. Shake hands with super hot baseball players

6. Meet some of my SMAns"

Mike says there is no rhyme or reason to him writing in Avery's perspective.

He told reporters that he doesn't know what it is like to be a little girl, but draws on his experience having "a bunch of sisters."

He is the single son in a family of three older sisters.

Despite the cheery picture the posts paint, the Canahuatis had a difficult Easter weekend when they tried to come to terms with their baby's fatal disorder.

Laura said the family sat around for two days crying and "being devastated".

Nothing they can do

They had to absorb the cruel news that there was no cure and absolutely nothing they could do to help her. They had to accept the fact that Avery's fate was out of their hands and not within their control.

Besides the blog, there

is a Facebook page and Twitter account encouraging couples to get tested

on whether they are carriers of the SMA gene.

SMA is the top genetic killer of infants and children under the age of two. However, most people remain ignorant of it and medical institutions rarely offer tests for it.

According to the couple living in Bellaire, Texas, near Houston, it's not even included when performing genetic pre-screening tests for other potential diseases and disorders.

And while some insurance companies cover the testing costs, others don't.

One in 40 people are carriers of the SMA gene. Meaning that each couple has a one in 1,600 chance of both having it, and a one in 6,400 chance that the baby will be born a sufferer.

Laura, 29, a kindergarten teacher, has taken a leave of absence to care for her daughter and deal with the occasional medical frights.

On April 26, the couple had to send Avery to the hospital when her oxygen levels and heart beats per minute went 'crazy', triggered by milk being fed to her too much and too fast.

All the time in the world to cry when it's over

This caused major reflux issues and affected her swallowing and breathing.

However, the Canahuatis,

in their signature optimistic style, took the best view of the

situation, writing that Avery "got to ride in an ambulance with two

muscular firemen who wouldn't take their eyes off of me."

"I try to keep it as fun and lighthearted as possible within the realm that this is serious," said Mike, in an attempt to make people understand what is SMA and what everybody who loves Avery is going through.

"It's making people realize, 'Hey, my life is not that bad, I need to go hug my kid and I need to do something nice for my wife or my kid,'" he said.

Born on November 11, Avery has about 18 months more left for her to spend time with her loved ones.

Her legs have been rendered immobile, and her arms are showing less movements each day.

Her mother said for now, they will enjoy each moment they have with her in happiness, instead of choosing to cry all day.

"We have all the time in the world to cry when this is over," she said.

Go to the Canahuatis' blog to learn more

For Mike and Laura Canahuati, they chose to write a blog in her name - detailing their daily joys and trials with her, accompanied with a 'bucket list' of things to accomplish before her death.

Baby Avery was diagnosed with Spinal Muscular Atrophy (SMA) Type 1 on a Good Friday, June 4, 2012.

When this happens, it will become increasingly difficult and in the end impossible for her body to pump air through her lungs.

This is why most babies diagnosed with SMA Type 1 have a life expectancy of less than two years of age.

There is even the possibility of dying a few months or even weeks after birth. Even with the help of a respirator, life expectancy can only be stretched till ten years of age.

One in 6,000 babies is born with one of four types of SMA, with Type Zero the worst. However, that usually occurs with fetuses, the couple said.

Much of the blog, written in the first person in Avery's voice, is the work of the father, Mike.

He writes: "My mommy, daddy, and grandparents have chosen to help me fight this disease, while embracing this news and helping me chronicle my "bucket list" experiences through this blog."

"So at this point, my family & friends can either sit back and watch me die and let my life be about doctors visits and tear filled days, or everyone can embrace what my future holds and we can make each day I'm here a memorable one...starting now."

Light-hearted and humorous, the blog and the bucket list is written as though Avery will live far beyond her estimated life expectancy and experience life's milestones.

In her wish-list, 'Avery' writes her hopes of 'attending a sleep over', 'going hiking', to 'play dress up in my mommy's closet and have a photo shoot' and 'celebrate my real 1st birthday'.

Others include:

- Lose my first tooth and get a present from the tooth fairy

- Meet Santa Claus

- Dress up for Halloween and go trick or treating

- Get a tattoo

- Have a father daughter dance while watching Father of The Bride

"Today started like most days, I woke up, ate breakfast through my glam-tube, took a bath, and then checked my blog to see if anyone is reading my story and helping me spread awareness about SMA.

"Well, when I woke up yesterday I had 480,000 pageviews and as of right now I have 1.29 million pageviews (and that number is increasing by about 2.5 pageviews per second).

"Holy...Shitake mushrooms??? Umm, I'm not certain, but I believe they are with the rest of the produce sir. Ugh sorry, do I look like work here? Anyway, where was I?", reads one of the latest entries.

Mike, an insurance company owner, says he conjures up a little girl's perspective when he writes. He added that many people are surprised to find out it's the dad, not mom, typing out the sensitive tear-jerker entries.

The couple first began the blog as an efficient way to keep family and close friends in touch about little Avery's health.

In each post, they include a plea for readers to share Avery's story in the hope of spreading SMA awareness.

In her voice, they call on couples to get SMA testing, and medical organisations and insurance companies to offer SMA testing, so nobody has to go through what Avery's family is going through every day.

"The only way to do this is to make people aware of SMA so they know they have the OPTION of getting tested for it. That's all I want and that's all my mommy & daddy want for me and all of my future friends," 'Avery' writes.

The list began as the wistful imagination of Mike and Laura living out a normal life with Avery through her teenage years and beyond, wishing for her to try cupcakes, fly a kite and blow bubbles.

But slowly, emails started pouring in with people asking them to add things into the list.

Crossing items off the list

Others offered help for the Canahuatis to strike off items from the list.

In April 2012, Avery even got to throw the first pitch at a Sugar Land Skeeters baseball game.

During the game held in honour of SMA awareness, Mike got to strike off several more items off the list, including:

1. Go to my first baseball game

2. Throw out the first pitch at a baseball game

3. Throw a strike...whatever that means

4. Have thousands of people cheer for me at once

5. Shake hands with super hot baseball players

6. Meet some of my SMAns"

Mike says there is no rhyme or reason to him writing in Avery's perspective.

He told reporters that he doesn't know what it is like to be a little girl, but draws on his experience having "a bunch of sisters."

He is the single son in a family of three older sisters.

Despite the cheery picture the posts paint, the Canahuatis had a difficult Easter weekend when they tried to come to terms with their baby's fatal disorder.

Laura said the family sat around for two days crying and "being devastated".

Nothing they can do

They had to absorb the cruel news that there was no cure and absolutely nothing they could do to help her. They had to accept the fact that Avery's fate was out of their hands and not within their control.

SMA is the top genetic killer of infants and children under the age of two. However, most people remain ignorant of it and medical institutions rarely offer tests for it.

According to the couple living in Bellaire, Texas, near Houston, it's not even included when performing genetic pre-screening tests for other potential diseases and disorders.

And while some insurance companies cover the testing costs, others don't.

One in 40 people are carriers of the SMA gene. Meaning that each couple has a one in 1,600 chance of both having it, and a one in 6,400 chance that the baby will be born a sufferer.

Laura, 29, a kindergarten teacher, has taken a leave of absence to care for her daughter and deal with the occasional medical frights.

On April 26, the couple had to send Avery to the hospital when her oxygen levels and heart beats per minute went 'crazy', triggered by milk being fed to her too much and too fast.

All the time in the world to cry when it's over

This caused major reflux issues and affected her swallowing and breathing.

"I try to keep it as fun and lighthearted as possible within the realm that this is serious," said Mike, in an attempt to make people understand what is SMA and what everybody who loves Avery is going through.

"It's making people realize, 'Hey, my life is not that bad, I need to go hug my kid and I need to do something nice for my wife or my kid,'" he said.

Born on November 11, Avery has about 18 months more left for her to spend time with her loved ones.

Her legs have been rendered immobile, and her arms are showing less movements each day.

Her mother said for now, they will enjoy each moment they have with her in happiness, instead of choosing to cry all day.

"We have all the time in the world to cry when this is over," she said.

Go to the Canahuatis' blog to learn more

Wages can be raised through productivity: PM Lee

Higher wages can push up business costs, affecting competitiveness

and may cause higher inflation, warned Prime Minister Lee Hsien Loong.

In order to sustain better wages and higher living standards, productivity among workers must be raised.

Mr Lee said that raising productivity is "more important than ever in our mature economy, because it is the only way to upgrade ourselves and our lives."

In his May Day message, the prime minister also urged every worker, whether rank-and-file or Professionals, Managers, Executives and Technicians (PMETs), to continue to upgrade and master new skills.

"Raising our productivity will benefit workers, firms, and our economy as a whole. Workers can earn more in higher-quality jobs.

"Firms can prosper and expand their businesses here. Our economy can continue to thrive despite more intense global competition," said Mr Lee.

Looking ahead, Mr Lee said that Singaporeans must prepare for a more challenging economic environment, as globalisation has shortened economic cycles, and ups and downs happen much faster, with less warning.

The prime minister's message is the latest to come from employers and politicians over a highly debated suggestion on raising wages substantially.

In order to sustain better wages and higher living standards, productivity among workers must be raised.

Mr Lee said that raising productivity is "more important than ever in our mature economy, because it is the only way to upgrade ourselves and our lives."

In his May Day message, the prime minister also urged every worker, whether rank-and-file or Professionals, Managers, Executives and Technicians (PMETs), to continue to upgrade and master new skills.

"Raising our productivity will benefit workers, firms, and our economy as a whole. Workers can earn more in higher-quality jobs.

"Firms can prosper and expand their businesses here. Our economy can continue to thrive despite more intense global competition," said Mr Lee.

Looking ahead, Mr Lee said that Singaporeans must prepare for a more challenging economic environment, as globalisation has shortened economic cycles, and ups and downs happen much faster, with less warning.

The prime minister's message is the latest to come from employers and politicians over a highly debated suggestion on raising wages substantially.

SMRT's Q4 profit drops 59%

SINGAPORE - Singapore's main subway operator SMRT Corp Ltd reported

on Monday a 59 percent drop in fiscal fourth-quarter net profit, hurt by

higher operating expenses and impairment of goodwill on its bus

operations.

The company earned S$13.9 million in the three months ended March, down from S$34 million a year earlier.

SMRT declared a reduced final dividend of 5.70 Singapore cents compared with 6.75 cents a year ago.

SMRT

shares have fallen around 7 percent since it said last week it would

spend S$900 million to overhaul the train system following numerous

breakdowns in recent months. Part of the cost will be borne by the

government's Land Transport Authority (LTA).

"We are still in discussion with LTA on cost-sharing arrangements," interim CEO Tan Ek Kia said in a statement.

Under Singapore's regulatory framework for public transport, LTA owns the assets but SMRT is responsible for the operation and maintenance of the train system.

Looking ahead, SMRT said it expects revenue to rise in the next 12 months due to the expected rise in train and bus ridership. But earnings will be hurt by higher repair and maintenance costs, as well as expenses on energy and staff.

Several analysts have downgraded the stock or cut their price targets on concerns such as higher operational costs, regulatory risks and uncertainty surrounding the appointment of a new chief executive.

Out of 17 analysts covering the stock, 10 have sell or strong sell ratings, four have hold recommendations, while the remaining three have buy or strong buy calls, according to Thomson Reuters data.

SMRT shares fell 0.3 percent to close at S$1.68 on Monday.

The company earned S$13.9 million in the three months ended March, down from S$34 million a year earlier.

SMRT declared a reduced final dividend of 5.70 Singapore cents compared with 6.75 cents a year ago.

"We are still in discussion with LTA on cost-sharing arrangements," interim CEO Tan Ek Kia said in a statement.

Under Singapore's regulatory framework for public transport, LTA owns the assets but SMRT is responsible for the operation and maintenance of the train system.

Looking ahead, SMRT said it expects revenue to rise in the next 12 months due to the expected rise in train and bus ridership. But earnings will be hurt by higher repair and maintenance costs, as well as expenses on energy and staff.

Several analysts have downgraded the stock or cut their price targets on concerns such as higher operational costs, regulatory risks and uncertainty surrounding the appointment of a new chief executive.

Out of 17 analysts covering the stock, 10 have sell or strong sell ratings, four have hold recommendations, while the remaining three have buy or strong buy calls, according to Thomson Reuters data.

SMRT shares fell 0.3 percent to close at S$1.68 on Monday.

Sunday, April 29, 2012

$70m to help low-wage workers through IGP

In its drive to restructure Singapore's economy, the Government will

also step up measures to ensure the blue-collar workforce is not left

behind.

$70 million has been set aside for the next three years for the existing Inclusive Growth Programme (IGP), which will help companies - especially those employing low-wage workers - raise productivity.

Around 70,000 workers are expected to benefit as their companies tap on IGP's help and co-funding to adopt new technologies, streamline work processes and train staff.

Announcing

this at a May Day dinner on Sunday, Deputy Prime Minister and Minister

for Finance and Manpower Mr Tharman Shanmugaratnam said the IGP, which

was launched in Aug 2010, is working.

As a result of the programme, some 33,000 low-wage workers have seen, on average, a basic pay increase of about 10 per cent, he said.

IGP is administered by NTUC and the Employment and Employability Institute (e2i), with over $30 million committed to the programme in the past two years.

"We must restructure our economy, to create better jobs and enable our workers to earn significantly higher pay over the next decade," Mr Tharman said.

"We are working to ensure that low-paid workers are the chief beneficiaries of our economic restructuring efforts."

$70 million has been set aside for the next three years for the existing Inclusive Growth Programme (IGP), which will help companies - especially those employing low-wage workers - raise productivity.

Around 70,000 workers are expected to benefit as their companies tap on IGP's help and co-funding to adopt new technologies, streamline work processes and train staff.

As a result of the programme, some 33,000 low-wage workers have seen, on average, a basic pay increase of about 10 per cent, he said.

IGP is administered by NTUC and the Employment and Employability Institute (e2i), with over $30 million committed to the programme in the past two years.

"We must restructure our economy, to create better jobs and enable our workers to earn significantly higher pay over the next decade," Mr Tharman said.

"We are working to ensure that low-paid workers are the chief beneficiaries of our economic restructuring efforts."

DPM Tharman: Average S'porean won't feel the sharp effects of inflation

The average Singapore will not feel the effects of a sharp inflation,

Deputy Prime Minister and Finance Minister Tharman Shanmugaratnam said

today in a speech at this year's May Day dinner.

He acknowledged that the 5.2 per cent increase in the Consumer Price Index (CPI) for March 2012 compared to a year ago, was a "high figure".

But more than half of this inflation rate of 5.2 per cent comes from higher COE premiums on cars and the effect of higher market rents on homes, the Manpower Minister said.

So those who already own their homes and are not buying a new car will be unaffected.

In fact for most Singaporeans, inflation in actual household expenses is lower than 5 per cent.

Mr Tharman explained that the increase in prices of daily necessities and essential services, such as food, clothing and footwear, and education, has actually been much more moderate, at 3.0 per cent or lower.

Nevertheless the Government is closely monitoring the situation, including prices of everyday goods and services, Mr Tharman said.

Inflation remains an important challenge and it is also one that union leaders are most concerned about, he said.

The Monetary Authority of Singapore has been gradually strengthening the value of the Singapore dollar to reduce the impact of imported inflation.

Actions have also been taken to cool the property market as an overheated property market with inflated property prices, while by themselves not part of the CPI, can drive up other prices.

He acknowledged that the 5.2 per cent increase in the Consumer Price Index (CPI) for March 2012 compared to a year ago, was a "high figure".

But more than half of this inflation rate of 5.2 per cent comes from higher COE premiums on cars and the effect of higher market rents on homes, the Manpower Minister said.

In fact for most Singaporeans, inflation in actual household expenses is lower than 5 per cent.

Mr Tharman explained that the increase in prices of daily necessities and essential services, such as food, clothing and footwear, and education, has actually been much more moderate, at 3.0 per cent or lower.

Nevertheless the Government is closely monitoring the situation, including prices of everyday goods and services, Mr Tharman said.

Inflation remains an important challenge and it is also one that union leaders are most concerned about, he said.

The Monetary Authority of Singapore has been gradually strengthening the value of the Singapore dollar to reduce the impact of imported inflation.

Actions have also been taken to cool the property market as an overheated property market with inflated property prices, while by themselves not part of the CPI, can drive up other prices.

Eldershield review needs to be calibrated very carefully: Gan Kim Yong

SINGAPORE: Health Minister Gan Kim Yong has stressed that the government needs to

"calibrate very carefully" any review to the ElderShield scheme - a severe disability insurance scheme.

Mr Gan was speaking on the sidelines of a community event where a new study was released, showing the benefits of brisk walking.

The study shows that members of Singapore's National Brisk Walking Programme are about eight per cent fitter compared to the general population.

Conducted by the Health Promotion Board, the survey covered 1,236 participants during a one-year period from September 2010 to September 2011.

Research has found that brisk walking regularly could help to decrease the risk of suffering from chronic conditions -- such as Type 2 diabetes, high blood pressure and breast cancer -- by almost 50 per cent.

Brisk walking can also help to prevent dementia and osteoporosis, and help manage one's weight in tandem with a healthy diet.

The National Brisk Walking Programme was introduced in 2009 to get Singaporeans who had a sedentary lifestyle exercising.

There are now 700 brisk walking clubs island-wide, and since the start of the programme, the number of participants has ballooned by 25 per cent to some 100,000 people.

Members of the brisk walking club get about 230 minutes of physical activity each week, the survey reported.

The amount is about three times more than the national average of about 80 minutes per week for seniors, who make up 60 per cent of the participants.

Minister for Health Gan Kim Yong said this was an encouraging sign, in view of Singapore's ageing population.

Chairman of the National Briskwalking Workgroup and Mayor for the North West District, Dr Teo Ho Pin, said there are now plans to reach out to more people.

"We are still trying to reach out to more minority groups especially our Indian friends because we still haven's attracted a lot of our Indian and Malay friends to join us in our brisk walking clubs," said Dr Teo.

Separately, Mr Gan also touched on calls to enhance Eldershield -- a severe disability insurance scheme that provides basic financial protection to those who need long-term care.

Some observers have said that current payouts are insufficient given high medical bills.

In 2007, the government increased the Eldershield monthly payout from S$300 to S$400, and the maximum payout period from 60 to 72 months.

Industry players have said the payout is insufficient, as patients' bills are at least twice that amount.

However, Mr Gan reiterated that there would be trade-offs accompanying any enhancement in payouts.

"We have to bear in mind that with enhancement, the cost of insurance will also go up," Mr Gan said.

"We'll have to calibrate very carefully to ensure that Eldershield remains affordable and at the same time the benefits remain effective to help our seniors."

A review of the ElderShield scheme is expected to take place in 2013.

Mr Gan was speaking on the sidelines of a community event where a new study was released, showing the benefits of brisk walking.

The study shows that members of Singapore's National Brisk Walking Programme are about eight per cent fitter compared to the general population.

Conducted by the Health Promotion Board, the survey covered 1,236 participants during a one-year period from September 2010 to September 2011.

Research has found that brisk walking regularly could help to decrease the risk of suffering from chronic conditions -- such as Type 2 diabetes, high blood pressure and breast cancer -- by almost 50 per cent.

Brisk walking can also help to prevent dementia and osteoporosis, and help manage one's weight in tandem with a healthy diet.

The National Brisk Walking Programme was introduced in 2009 to get Singaporeans who had a sedentary lifestyle exercising.

There are now 700 brisk walking clubs island-wide, and since the start of the programme, the number of participants has ballooned by 25 per cent to some 100,000 people.

Members of the brisk walking club get about 230 minutes of physical activity each week, the survey reported.

The amount is about three times more than the national average of about 80 minutes per week for seniors, who make up 60 per cent of the participants.

Minister for Health Gan Kim Yong said this was an encouraging sign, in view of Singapore's ageing population.

Chairman of the National Briskwalking Workgroup and Mayor for the North West District, Dr Teo Ho Pin, said there are now plans to reach out to more people.

"We are still trying to reach out to more minority groups especially our Indian friends because we still haven's attracted a lot of our Indian and Malay friends to join us in our brisk walking clubs," said Dr Teo.

Separately, Mr Gan also touched on calls to enhance Eldershield -- a severe disability insurance scheme that provides basic financial protection to those who need long-term care.

Some observers have said that current payouts are insufficient given high medical bills.

In 2007, the government increased the Eldershield monthly payout from S$300 to S$400, and the maximum payout period from 60 to 72 months.

Industry players have said the payout is insufficient, as patients' bills are at least twice that amount.

However, Mr Gan reiterated that there would be trade-offs accompanying any enhancement in payouts.

"We have to bear in mind that with enhancement, the cost of insurance will also go up," Mr Gan said.

"We'll have to calibrate very carefully to ensure that Eldershield remains affordable and at the same time the benefits remain effective to help our seniors."

A review of the ElderShield scheme is expected to take place in 2013.

HPB to reward senior citizens who brisk walk regularly

SINGAPORE: The

Health Promotion Board (HPB) on Sunday released the findings of a study

involving 1,200 seniors, which showed that those who participated in the

National Brisk Walking Programme were, on average, eight per cent

fitter than their peers.

The HPB also revealed that it is coming up with a reward system for seniors who spend at least 100 minutes a week brisk walking.

These seniors will be assessed every six months and could qualify for yearly awards. Those who achieve at least 200 minutes of brisk walking a week will attain the gold award, while those who brisk walk for at least 150 and 100 minutes will get the silver and bronze awards respectively.

The awards come with certificates and vouchers that can be used to buy healthy food.

The rewards will be offered to 100,000 constituents in the 700 brisk-walking clubs here and will progressively be rolled out islandwide, said HPB chief executive officer Ang Hak Seng.

"The reward is not about giving them something ... but about (providing) them a sense of accomplishment," Mr Ang said, adding that more details will be announced later.

To mark the third anniversary of the National Brisk Walking Programme, 10,000 residents took part in brisk-walking sessions across the island.

Health Minister Gan Kim Yong, who was at one of the sessions, noted that exercise such as brisk walking is increasingly important to cope with the challenges of an ageing population.

"One of the key strategies to address this challenge is to encourage Singaporeans to live well and stay active, healthy and engaged. For this reason, the brisk-walking club is a very important part of this strategy.

"Through brisk walking, Singaporeans can work out together (and) stay healthy," said Mr Gan, who shared that he brisk walks up to twice a day on weekends.

North-West District Mayor Teo Ho Pin, who chairs the National Brisk Walking Workgroup, said there are plans to reach out further to minorities such as Indians and Malays, as not many have joined the groups.

To encourage greater participation among all Singaporeans, Mr Ang said "bite-sized" brisk-walking exercises will be introduced during community events.

The South-West Community Development Council (CDC) will start a pilot for such exercises, which will be rolled out by other CDCs over the next three years.

Brisk-walking events with special themes - such as paranormal walks and speed-dating walks - will also be held between July and August, Mr Ang added.

The HPB also revealed that it is coming up with a reward system for seniors who spend at least 100 minutes a week brisk walking.

These seniors will be assessed every six months and could qualify for yearly awards. Those who achieve at least 200 minutes of brisk walking a week will attain the gold award, while those who brisk walk for at least 150 and 100 minutes will get the silver and bronze awards respectively.

The awards come with certificates and vouchers that can be used to buy healthy food.

The rewards will be offered to 100,000 constituents in the 700 brisk-walking clubs here and will progressively be rolled out islandwide, said HPB chief executive officer Ang Hak Seng.

"The reward is not about giving them something ... but about (providing) them a sense of accomplishment," Mr Ang said, adding that more details will be announced later.

To mark the third anniversary of the National Brisk Walking Programme, 10,000 residents took part in brisk-walking sessions across the island.

Health Minister Gan Kim Yong, who was at one of the sessions, noted that exercise such as brisk walking is increasingly important to cope with the challenges of an ageing population.

"One of the key strategies to address this challenge is to encourage Singaporeans to live well and stay active, healthy and engaged. For this reason, the brisk-walking club is a very important part of this strategy.

"Through brisk walking, Singaporeans can work out together (and) stay healthy," said Mr Gan, who shared that he brisk walks up to twice a day on weekends.

North-West District Mayor Teo Ho Pin, who chairs the National Brisk Walking Workgroup, said there are plans to reach out further to minorities such as Indians and Malays, as not many have joined the groups.

To encourage greater participation among all Singaporeans, Mr Ang said "bite-sized" brisk-walking exercises will be introduced during community events.

The South-West Community Development Council (CDC) will start a pilot for such exercises, which will be rolled out by other CDCs over the next three years.

Brisk-walking events with special themes - such as paranormal walks and speed-dating walks - will also be held between July and August, Mr Ang added.

Govt closely monitoring inflation: DPM Tharman

SINGAPORE: Deputy

Prime Minister and Minister for Finance and Manpower Tharman

Shanmugaratnam has assured Singaporeans that the government is closely

monitoring inflation including prices of everyday goods and services.

Speaking at the May Day dinner, he noted that inflation remains an important challenge and one that union leaders are most concerned about.

This year's May Day dinner comes at a time of continuing uncertainty in the global economy, caused especially by the problems in Europe, said Mr Tharman.

In Singapore however, he said the economy is not in a bad shape.

"Our unemployment rate remains lower than in most other countries. This is due to the very large number of jobs created last year. With the economic slowdown, we have seen a pick-up in redundancies since the last quarter of 2011, and can expect a slight increase in unemployment in the short term as displaced workers take some time to find new jobs," said Mr Tharman.

Singapore's Consumer Price Index (CPI) rose by about 5.2 per cent in March 2012 compared to a year ago and he said this is a high figure.

However, he also explained that this does not mean that the average Singaporean will feel this high inflation.

That is because more than half of the headline inflation rate of 5.2 per cent came from higher COEs for cars and the effect of higher market rent on houses.

Mr Tharman assured that the vast majority of Singaporeans who already own their homes and are not buying new cars will not feel the effects of these sharp increases.

Mr Tharman also said the increase in prices of daily necessities and essential services such as food and clothing have actually been much more moderate at three per cent or lower.

"The vast majority of Singaporeans, who already own their homes and are not buying a new car, will not feel the effects of these sharp increases. The increase in prices of daily necessities and essential services, such as food, clothing & footwear and education, has actually been much more moderate, at three per cent or lower. The inflation in actual household expenditures for most Singaporeans is hence lower than five per cent," said Mr Tharman.

He added: "Nevertheless, we are closely monitoring the situation, including prices of everyday goods and services. MAS has been strengthening the value of our dollar to reduce the impact of imported inflation. The government has taken actions to cool the property market. Although property prices are not part of the consumer price index, in an overheated property market, many other prices can also go up. We will keep a close watch on the property market.

"In the meantime too, the government is providing some help for Singaporean households to cope with the rising cost of living. This year, we introduced GST vouchers, which will help lower income Singaporeans and especially our older folk with their expenses."

Mr Tharman noted that the National Wages Council has been discussing the wage guidelines for 2012 and 2013 and he is sure that they will consider all factors carefully before making their recommendations, expected by June.

Mr Tharman hopes that the guidelines will allow workers to get their fair share from the growth over the past year and get wage increases that can be sustained while still ensuring that businesses in Singapore remain competitive and continue to generate good jobs.

Speaking at the May Day dinner, he noted that inflation remains an important challenge and one that union leaders are most concerned about.

This year's May Day dinner comes at a time of continuing uncertainty in the global economy, caused especially by the problems in Europe, said Mr Tharman.

In Singapore however, he said the economy is not in a bad shape.

"Our unemployment rate remains lower than in most other countries. This is due to the very large number of jobs created last year. With the economic slowdown, we have seen a pick-up in redundancies since the last quarter of 2011, and can expect a slight increase in unemployment in the short term as displaced workers take some time to find new jobs," said Mr Tharman.

Singapore's Consumer Price Index (CPI) rose by about 5.2 per cent in March 2012 compared to a year ago and he said this is a high figure.

However, he also explained that this does not mean that the average Singaporean will feel this high inflation.

That is because more than half of the headline inflation rate of 5.2 per cent came from higher COEs for cars and the effect of higher market rent on houses.

Mr Tharman assured that the vast majority of Singaporeans who already own their homes and are not buying new cars will not feel the effects of these sharp increases.

Mr Tharman also said the increase in prices of daily necessities and essential services such as food and clothing have actually been much more moderate at three per cent or lower.

"The vast majority of Singaporeans, who already own their homes and are not buying a new car, will not feel the effects of these sharp increases. The increase in prices of daily necessities and essential services, such as food, clothing & footwear and education, has actually been much more moderate, at three per cent or lower. The inflation in actual household expenditures for most Singaporeans is hence lower than five per cent," said Mr Tharman.

He added: "Nevertheless, we are closely monitoring the situation, including prices of everyday goods and services. MAS has been strengthening the value of our dollar to reduce the impact of imported inflation. The government has taken actions to cool the property market. Although property prices are not part of the consumer price index, in an overheated property market, many other prices can also go up. We will keep a close watch on the property market.

"In the meantime too, the government is providing some help for Singaporean households to cope with the rising cost of living. This year, we introduced GST vouchers, which will help lower income Singaporeans and especially our older folk with their expenses."

Mr Tharman noted that the National Wages Council has been discussing the wage guidelines for 2012 and 2013 and he is sure that they will consider all factors carefully before making their recommendations, expected by June.

Mr Tharman hopes that the guidelines will allow workers to get their fair share from the growth over the past year and get wage increases that can be sustained while still ensuring that businesses in Singapore remain competitive and continue to generate good jobs.

Friday, April 27, 2012

Some 9,990 workers laid off in Singapore

SINGAPORE: Amid more moderate economic growth, more workers were laid off in 2011, especially in the fourth quarter of the year.

Some 9,990 workers were laid off last year, up slightly from the 9,800 in 2010.

But the Ministry of Manpower (MOM) said seven out of 10 residents who were laid off were re-employed within a year.

This is according to MOM's yearly Redundancy and Re-employment Report.

With a larger employment base, however, the incidence of redundancy dropped.

5.5 workers were laid off for every 1,000 employees in 2011, down from 5.7 in 2010.

Redundancies for the past two years remain substantially lower than the more than 23,000 workers laid off during the recession in 2009.

Mr Yeo Guat Kwang, director, Workplace Safety and Health, NTUC, said: "The economic situation is getting more challenging, and the economic cycle is getting shorter, so it's inevitable that we'll see such figures going up and down.

"Fortunately, I think based on the last two years' figures, we don't have a significant trend to show that it's been getting worse.

"It's important that we continue to strengthen our efforts to strengthen employment and employability capability of all the workers. We need to take good care of those who're affected, although the numbers are still small."

Production, transport operators and cleaning workers formed the largest group of layoffs, at 47.6 per cent.

Professionals, managers, executives and technicians (PMETs) came in second at 41.7 per cent.

The remaining 11 per cent were clerical, sales and service workers.

For companies, restructuring and high labour cost were the top two reasons for laying off workers, followed by high operating cost and business re-organisation.

Singapore National Employers Federation assistant executive-director Tan Kwang Cheak said: "If we look at overall context of how the economy is, how competitive it has been, not only in Singapore but globally, I think companies are constantly looking for ways to restructure, to improve their processes, to, in essence, be more competitive as they seek greater growth.

"So I think it reflects that ongoing process for companies."

In addition, the manpower report said the average time a laid-off worker took to find a job, was about two months.

Those in clerical, sales and service jobs, as well as those who're younger, took the shortest time.

Data showed re-entry into employment has been improving for the past three years.

Seventy per cent of residents laid off in the first three quarters of 2011 found jobs within a year, up from 66 per cent in 2010, and 65 per cent in 2009.

Some 9,990 workers were laid off last year, up slightly from the 9,800 in 2010.

But the Ministry of Manpower (MOM) said seven out of 10 residents who were laid off were re-employed within a year.

This is according to MOM's yearly Redundancy and Re-employment Report.

With a larger employment base, however, the incidence of redundancy dropped.

5.5 workers were laid off for every 1,000 employees in 2011, down from 5.7 in 2010.

Redundancies for the past two years remain substantially lower than the more than 23,000 workers laid off during the recession in 2009.

Mr Yeo Guat Kwang, director, Workplace Safety and Health, NTUC, said: "The economic situation is getting more challenging, and the economic cycle is getting shorter, so it's inevitable that we'll see such figures going up and down.

"Fortunately, I think based on the last two years' figures, we don't have a significant trend to show that it's been getting worse.

"It's important that we continue to strengthen our efforts to strengthen employment and employability capability of all the workers. We need to take good care of those who're affected, although the numbers are still small."

Production, transport operators and cleaning workers formed the largest group of layoffs, at 47.6 per cent.

Professionals, managers, executives and technicians (PMETs) came in second at 41.7 per cent.

The remaining 11 per cent were clerical, sales and service workers.

For companies, restructuring and high labour cost were the top two reasons for laying off workers, followed by high operating cost and business re-organisation.

Singapore National Employers Federation assistant executive-director Tan Kwang Cheak said: "If we look at overall context of how the economy is, how competitive it has been, not only in Singapore but globally, I think companies are constantly looking for ways to restructure, to improve their processes, to, in essence, be more competitive as they seek greater growth.

"So I think it reflects that ongoing process for companies."

In addition, the manpower report said the average time a laid-off worker took to find a job, was about two months.

Those in clerical, sales and service jobs, as well as those who're younger, took the shortest time.

Data showed re-entry into employment has been improving for the past three years.

Seventy per cent of residents laid off in the first three quarters of 2011 found jobs within a year, up from 66 per cent in 2010, and 65 per cent in 2009.

SingTel says sells stake in Far EasTone for $340m

SINGAPORE - Singapore Telecommunications Ltd (SingTel) confirmed on

Friday it has divested its 3.98 per cent stake in Taiwan's Far EasTone

Telecommunications Co Ltd for T$8.03 billion (S$340 million).

SingTel, Southeast Asia's biggest telecoms firm, said it will see a gain of about S$118 million (US$95 million) from the on-market sale. The gain will be reflected in the first quarter ending June 30.

On Thursday IFR reported SingTel was selling its stake in Far EasTone and Goldman Sachs was the sole bookrunner for the deal.

SingTel, Southeast Asia's biggest telecoms firm, said it will see a gain of about S$118 million (US$95 million) from the on-market sale. The gain will be reflected in the first quarter ending June 30.

On Thursday IFR reported SingTel was selling its stake in Far EasTone and Goldman Sachs was the sole bookrunner for the deal.

DPM Tharman on inclusive growth

SINGAPORE'S main focus is on the long-term challenge of building a

better future for its people, said Deputy Prime Minister and Manpower

Minister Tharman Shanmugaratnam.

In his May Day Message yesterday, he said that everything the Government does is "ultimately aimed at achieving inclusive growth" which benefits all Singaporean workers.

He said: "We must press on with our efforts to restructure Singapore's economy, so that we can grow on the basis of productivity and support higher wages for our workers."

This is where the country's tripartite partnership between workers, employers and the Government plays a key role in engaging companies, he said.

Mr Tharman added that the Government is working with small and medium-sized enterprises especially, to help them upgrade their operations and stay competitive in a tight labour market.

To help lower-wage workers, the Workfare Income Supplement and Workfare Training Support schemes have been put in place to encourage them to find regular work. The schemes have also helped them progress through training and skills upgrading.

He said that the Manpower Ministry will step up awareness and enforcement efforts to ensure that employers comply with the Central Provident Fund (CPF) Act and the Employment Act.

This is so that lower-wage workers receive CPF contributions and statutory employment benefits from their employers.

As many lower-wage workers are employed in industries where outsourcing is common - such as cleaning and security - the Government is working closely with its tripartite partners to promote best sourcing.

He said that the Government, as a major service buyer, will lead by example in this aspect, by procuring only from accredited cleaning companies and well-graded security agencies.

The Retirement and Re-employment Act and the Special Employment Credit - to help older workers - will be monitored closely and studied for their implementation and impact, he said.

Mr Tharman also highlighted the need to develop a "strong Singapore core of employees", including professionals, managers and executives.

"We have to keep to the right balance. We must stay open to expertise from around the world and enable our companies to have the diverse teams that allow them to remain competitive."

In his May Day Message yesterday, he said that everything the Government does is "ultimately aimed at achieving inclusive growth" which benefits all Singaporean workers.

He said: "We must press on with our efforts to restructure Singapore's economy, so that we can grow on the basis of productivity and support higher wages for our workers."

This is where the country's tripartite partnership between workers, employers and the Government plays a key role in engaging companies, he said.

Mr Tharman added that the Government is working with small and medium-sized enterprises especially, to help them upgrade their operations and stay competitive in a tight labour market.

To help lower-wage workers, the Workfare Income Supplement and Workfare Training Support schemes have been put in place to encourage them to find regular work. The schemes have also helped them progress through training and skills upgrading.

He said that the Manpower Ministry will step up awareness and enforcement efforts to ensure that employers comply with the Central Provident Fund (CPF) Act and the Employment Act.

This is so that lower-wage workers receive CPF contributions and statutory employment benefits from their employers.

As many lower-wage workers are employed in industries where outsourcing is common - such as cleaning and security - the Government is working closely with its tripartite partners to promote best sourcing.

He said that the Government, as a major service buyer, will lead by example in this aspect, by procuring only from accredited cleaning companies and well-graded security agencies.

The Retirement and Re-employment Act and the Special Employment Credit - to help older workers - will be monitored closely and studied for their implementation and impact, he said.

Mr Tharman also highlighted the need to develop a "strong Singapore core of employees", including professionals, managers and executives.

"We have to keep to the right balance. We must stay open to expertise from around the world and enable our companies to have the diverse teams that allow them to remain competitive."

PMETs still vulnerable to layoffs

SINGAPORE - Professionals, managers, executives and technicians

(PMETs) remain vulnerable to layoffs, according to a report released by

the Ministry of Manpower (MOM) yesterday.

Among occupational groups, PMETs were the second-most vulnerable, after those holding production jobs.

The third-most vulnerable group were those in clerical and sales positions.

Last year, about 4,170 PMETs were made redundant - retrenched or released early from contract - up from 3,450 in 2010.

Overall, some 9,990 workers were laid off last year. Due to a rise in layoffs in the fourth quarter last year, the number of employees made redundant was higher than the 9,800 in 2010.

Still, against a larger employment base last year, the rate of redundancies - at 5.5 workers for every 1,000 employees - continued to decline from 5.7 in 2010. Last year's rate is the lowest since 1998, when MOM first released the annual Redundancy And Re-entry Into Employment report.

Mr David Ang, executive director of the Singapore Human Resources Institute, said that the rise in the number of PMETs displaced last year could be attributed to restructuring among companies in sectors such as manufacturing and services.

"Sometimes, companies merge or streamline their operations and, in the process, employees working in jobs like sales and marketing may end up losing their jobs," he told my paper.

"There may not be space for these employees, who used to hold positions that have now been combined with those in other departments or removed totally."

This was reflected in the report, which cited restructuring for greater efficiency and increased labour costs as the two main reasons for redundancies.

Workers in the manufacturing sector continued to be the most susceptible to redundancies. About 11 employees were laid off for every 1,000 of such workers last year.

This was drastically higher as compared to the 3.8 per 1,000 workers laid off in the services sector, and the 4.2 workers laid off for every 1,000 in the construction sector over the same period.

Meanwhile, the rate of re-entry into employment for workers who were laid off last year improved for the second straight year.

The report showed that 70 per cent of workers - or seven in 10 - who were made redundant in the first three quarters of last year had managed to secure employment again by December.

This was an improvement over the 66 per cent figure for the previous cohort in 2010, and 65 per cent for the 2009 cohort.

On average, it took just over two months for these workers to land new jobs last year.

Younger employees, and those laid off from clerical, sales and service jobs, took the shortest time to clinch new jobs.

Among occupational groups, PMETs were the second-most vulnerable, after those holding production jobs.

The third-most vulnerable group were those in clerical and sales positions.

Last year, about 4,170 PMETs were made redundant - retrenched or released early from contract - up from 3,450 in 2010.

Overall, some 9,990 workers were laid off last year. Due to a rise in layoffs in the fourth quarter last year, the number of employees made redundant was higher than the 9,800 in 2010.

Still, against a larger employment base last year, the rate of redundancies - at 5.5 workers for every 1,000 employees - continued to decline from 5.7 in 2010. Last year's rate is the lowest since 1998, when MOM first released the annual Redundancy And Re-entry Into Employment report.

Mr David Ang, executive director of the Singapore Human Resources Institute, said that the rise in the number of PMETs displaced last year could be attributed to restructuring among companies in sectors such as manufacturing and services.

"Sometimes, companies merge or streamline their operations and, in the process, employees working in jobs like sales and marketing may end up losing their jobs," he told my paper.

"There may not be space for these employees, who used to hold positions that have now been combined with those in other departments or removed totally."

This was reflected in the report, which cited restructuring for greater efficiency and increased labour costs as the two main reasons for redundancies.

Workers in the manufacturing sector continued to be the most susceptible to redundancies. About 11 employees were laid off for every 1,000 of such workers last year.

This was drastically higher as compared to the 3.8 per 1,000 workers laid off in the services sector, and the 4.2 workers laid off for every 1,000 in the construction sector over the same period.

Meanwhile, the rate of re-entry into employment for workers who were laid off last year improved for the second straight year.

The report showed that 70 per cent of workers - or seven in 10 - who were made redundant in the first three quarters of last year had managed to secure employment again by December.

This was an improvement over the 66 per cent figure for the previous cohort in 2010, and 65 per cent for the 2009 cohort.

On average, it took just over two months for these workers to land new jobs last year.

Younger employees, and those laid off from clerical, sales and service jobs, took the shortest time to clinch new jobs.

Thursday, April 19, 2012

Nastiest travel nightmares

AT LEAST once a year, we cough out extra money from our kitty to spend on a

holiday to escape from the daily stresses of our lives.

And who can blame you for having high expectations that it will be perfect?

We do our due diligence to pack an extra set of clothes, a windbreaker, a few phone chargers and adapters, and even some basic medication.

But according to U.S. News, what most people do not prepare for are calamities.

This is simply because, no one ever imagines that bad things will happen to them, it said.

Last week, two major earthquakes struck off the Sumatra coast and triggered tsunami warnings in Malaysia, Indonesia, Sri Lanka and India.

Thailand evacuated areas along the Andaman Sea, including Phuket. Just 30 minutes after Mr Manjit Singh checked into his hotel on the island, he was greeted by sirens and crowds running on the streets with worried looks on their faces.

The 35-year-old Singaporean told The New Paper that he had to brace himself of the flooding and debris.

Luckily for Mr Singh and his friends, the tsunami never came.

So instead of being unprepared, here are seven tips on how to handle woeful travel dilemmas.

And who can blame you for having high expectations that it will be perfect?

We do our due diligence to pack an extra set of clothes, a windbreaker, a few phone chargers and adapters, and even some basic medication.

But according to U.S. News, what most people do not prepare for are calamities.

This is simply because, no one ever imagines that bad things will happen to them, it said.

Last week, two major earthquakes struck off the Sumatra coast and triggered tsunami warnings in Malaysia, Indonesia, Sri Lanka and India.

Thailand evacuated areas along the Andaman Sea, including Phuket. Just 30 minutes after Mr Manjit Singh checked into his hotel on the island, he was greeted by sirens and crowds running on the streets with worried looks on their faces.

The 35-year-old Singaporean told The New Paper that he had to brace himself of the flooding and debris.

Luckily for Mr Singh and his friends, the tsunami never came.

So instead of being unprepared, here are seven tips on how to handle woeful travel dilemmas.

1. If your flight is cancelled...

These days you are better off tweeting about your flight woes than trying to call through the airline hotline. Most airlines like Qantas and Singapore Airlines have Twitter channels and use it to post updates on flight delays or cancellation.

They also have dedicated resources so are are better equipped to assist customers.

While you may not get immediate compensation (if at all), the response time is quicker via Twitter and you know that at least your feedback is heard.

These days you are better off tweeting about your flight woes than trying to call through the airline hotline. Most airlines like Qantas and Singapore Airlines have Twitter channels and use it to post updates on flight delays or cancellation.

They also have dedicated resources so are are better equipped to assist customers.

While you may not get immediate compensation (if at all), the response time is quicker via Twitter and you know that at least your feedback is heard.

2. If the airline loses your bags...

For starters, always label your baggages. If they get lost because it wasn't labelled, then you don't get to blame the airline or hotel bellboys.

U.S. News also said that it is probably a good idea to pack a few essentials on your carry-on pack and check in early. This gives the airline sufficient time to ensure your luggage reaches cargo hold.

If you are at arrival and find that your bags are not on the carousel, don't panic as most airlines have sophisticated tracking systems and usually will be able to locate the missing item(s) within hours of you reporting loss. Also, be sure to get the right number to follow-up on your missing baggage - the onus is on you.

The U.S News said that if your luggage is declared permanently lost, you have up to 30 days (depending on the airline) to file a valid liability claim.

For starters, always label your baggages. If they get lost because it wasn't labelled, then you don't get to blame the airline or hotel bellboys.

U.S. News also said that it is probably a good idea to pack a few essentials on your carry-on pack and check in early. This gives the airline sufficient time to ensure your luggage reaches cargo hold.

If you are at arrival and find that your bags are not on the carousel, don't panic as most airlines have sophisticated tracking systems and usually will be able to locate the missing item(s) within hours of you reporting loss. Also, be sure to get the right number to follow-up on your missing baggage - the onus is on you.

The U.S News said that if your luggage is declared permanently lost, you have up to 30 days (depending on the airline) to file a valid liability claim.

4. If your passport is stolen…

Keep digital copies of your passport identification page. Also, save any visas on a secure online archive site (like Google Docs) so that you can access them from any computer to verify your identity.

Keep digital copies of your passport identification page. Also, save any visas on a secure online archive site (like Google Docs) so that you can access them from any computer to verify your identity.

4. If you get arrested...

Before you travel, you should brush up on the local customs and laws to avoid cultural misunderstands and having a brush with the law, according to U.S. News.

If you do get incarcerated, contact your local embassy or consulate immediately.

Before you travel, you should brush up on the local customs and laws to avoid cultural misunderstands and having a brush with the law, according to U.S. News.

If you do get incarcerated, contact your local embassy or consulate immediately.

5. If there's a medical emergency...

When you travel, it is probably wise to pack some basic painkillers or cold medication which will help to ease your misery and speed up recovery. Make sure the prescriptions are in their original bottles so they can be easily identified.

But what happens if it is more than a sniffle?

Before you leave home, check through your health insurance coverage to check if you are covered overseas. If not, it is probably prudent to purchase short-term cover so have your back while you are overseas, said U.S. News.

If you get injured or terribly sick while overseas, contact your embassy or consulate. They can help contact your family or personal doctor, recommend the best local medical care or even help you transfer money so you can pay for medical expenses, according to U.S. News.

When you travel, it is probably wise to pack some basic painkillers or cold medication which will help to ease your misery and speed up recovery. Make sure the prescriptions are in their original bottles so they can be easily identified.

But what happens if it is more than a sniffle?

Before you leave home, check through your health insurance coverage to check if you are covered overseas. If not, it is probably prudent to purchase short-term cover so have your back while you are overseas, said U.S. News.

If you get injured or terribly sick while overseas, contact your embassy or consulate. They can help contact your family or personal doctor, recommend the best local medical care or even help you transfer money so you can pay for medical expenses, according to U.S. News.

6. If there's a natural disaster...

Unfortunately, this is something no one can really be too prepared for when travelling. But you can read up on whether the area you are visiting is disaster-prone.

Leave your travel itinerary and a list of personal information including your passport number and telephone number with a trusted friend.

When you get to the destination, designate a meeting point with your travel companions so you can assemble there in case phone communications go out, said U.S. News.

Once again when disaster strikes, your embassy is your best friend. If you are out of the city, try to locate the nearest embassy or consulate with officers that speak your language and they will likely do their best to help you.

Lastly, stay calm and on top of the news for the lastest updates on the emergency situation.

7. If there's a state of emergency...

Political unrest tends to be volatile, so check your country's foreign affairs website for travel advisories.

If you are caught in political situation, a tip is to avoid public transport, taxis and popular tourist destinations as those are often popular targets of attack, according to U.S. News.

Check in with your embassy as often as possible so they know your whereabouts and how to contact you.

You might also want to consider leaving major cities in favor of smaller, quieter towns.

Lastly, get a Travel Insurance to protect you from the unforeseen and tide you through all your woes.

Unfortunately, this is something no one can really be too prepared for when travelling. But you can read up on whether the area you are visiting is disaster-prone.

Leave your travel itinerary and a list of personal information including your passport number and telephone number with a trusted friend.

When you get to the destination, designate a meeting point with your travel companions so you can assemble there in case phone communications go out, said U.S. News.

Once again when disaster strikes, your embassy is your best friend. If you are out of the city, try to locate the nearest embassy or consulate with officers that speak your language and they will likely do their best to help you.

Lastly, stay calm and on top of the news for the lastest updates on the emergency situation.

7. If there's a state of emergency...

Political unrest tends to be volatile, so check your country's foreign affairs website for travel advisories.

If you are caught in political situation, a tip is to avoid public transport, taxis and popular tourist destinations as those are often popular targets of attack, according to U.S. News.

Check in with your embassy as often as possible so they know your whereabouts and how to contact you.

You might also want to consider leaving major cities in favor of smaller, quieter towns.

Lastly, get a Travel Insurance to protect you from the unforeseen and tide you through all your woes.

Police to install CCTV cameras at 300 housing blocks, carparks

SINGAPORE: To better

prevent, deter and detect crime, police have started the installation

of cameras at 300 public housing blocks and multi-storey carparks.

It is part of the new S$160 million Community Policing System announced during this year's Budget.

The cameras will be installed in seven areas - Bukit Merah, Bishan, Clementi, Punggol, Sengkang, Tampines and Woodlands.

The move is part of a pilot phase to enhance frontline policing through technology.

The cameras will be placed at public spaces, as well as key entry and exit points. Signs will also be put up to indicate where the cameras are.

While there will not be "live" monitoring of cameras, the footage captured will be kept for a month. Police said this has worked in their favour in the past, with molesters and thieves arrested.

Residents have welcomed the initiative.

One of the residents said: "Criminal activities happen frequently around here, so now it will be safer."

The plan is to cover 10,000 public housing blocks and multi-storey carparks islandwide with the cameras by 2016.

Singapore's crime rate is relatively low, at about 600 crimes per 100,000 people.

It is part of the new S$160 million Community Policing System announced during this year's Budget.

The cameras will be installed in seven areas - Bukit Merah, Bishan, Clementi, Punggol, Sengkang, Tampines and Woodlands.

The move is part of a pilot phase to enhance frontline policing through technology.

The cameras will be placed at public spaces, as well as key entry and exit points. Signs will also be put up to indicate where the cameras are.

While there will not be "live" monitoring of cameras, the footage captured will be kept for a month. Police said this has worked in their favour in the past, with molesters and thieves arrested.

Residents have welcomed the initiative.

One of the residents said: "Criminal activities happen frequently around here, so now it will be safer."

The plan is to cover 10,000 public housing blocks and multi-storey carparks islandwide with the cameras by 2016.

Singapore's crime rate is relatively low, at about 600 crimes per 100,000 people.

Singapore shares open lower on Friday

Singapore shares opened lower on Friday, with the benchmark Straits Times Index at 2,999.28, down 0.30 per cent, or 8.93 points.

About 186 million shares exchanged hands.

Losers beat gainers 82 to 46.

About 186 million shares exchanged hands.

Losers beat gainers 82 to 46.

Wednesday, April 18, 2012

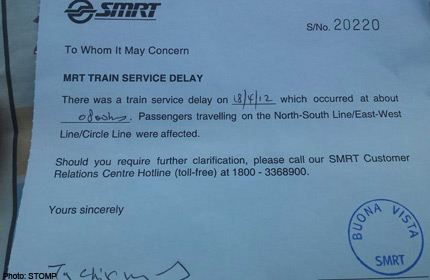

Late? Get a chit from SMRT

Commuters who get delayed as a result of train disruptions can ask

for excuse slips to present to their bosses or teachers to explain their

lateness.

These official slips - or excuse chits, as they are called - can be obtained at customer-service counters at any MRT station operated by SMRT, the transport operator said. They come complete with the date and time of a disruption, as well as a station stamp and staff signature.